Burtnett Insurance Agency Blog |

|

Usually, when we think of home or homeowners insurance, we think about the house itself; the roof, the walls, the floors and foundations. However, covering the personal property contained within is a huge part of such policies, too! Having a roof over our heads is obviously essential, but protecting our belongings - from the ordinary and everyday to the precious and valuable - is important, too. But coverage for personal property isn't uniform, and there are often coverage limits based on the type of property in question. While some items, like clothes and furniture, may be covered under "unscheduled personal property," more expensive items may need to be "scheduled." So what's the difference between unscheduled and scheduled personal property? What kind of property needs to be scheduled? That's what we're looking at today! What is unscheduled personal property? If you have a standard home, property, or homeowners insurance policy, then you likely know that it covers the house itself (which is referred to as the "dwelling coverage"), but it also provides coverage for personal property inside and out. For most basic home insurance policies, unscheduled personal property (UPP) refers to the majority of your common, everyday belongings like clothes, furniture, and appliances. It's called "unscheduled" personal property because you aren't required to schedule it, or keep a list of each individual item and its value. Instead, your policy provides a certain amount, or coverage limit, to cover the total value of these items collectively. In the event of a claim (such as a fire) where all of your belongings are lost, your insurance would pay either the replacement cost or actual cash value of those items up to the coverage limit after you've paid the deductible. Coverage limits for unscheduled personal property are usually expressed as a percentage of the dwelling coverage. For example, if your home insurance policy has a $100,000 limit for the house itself and your unscheduled personal property limit is listed as 50% of the dwelling coverage, then you have $50,000 of coverage for personal belongings. If you're uncertain what your dwelling coverage or unscheduled personal property coverage limits are, this information can be found on your policy's declarations page. However, certain items, like expensive furs, art, and jewelry will likely have sublimits built into the policy language. For example, while you may have a coverage limit of 50% of the dwelling coverage for unscheduled personal property in general, there may be individual limits, such as $1,500 for jewelry, or $2,500 for art pieces. This means your basic policy may provide some coverage for those types of valuable property, but only a limited amount. If you have belongings valued more than the sublimit, you can often purchase optional coverage that expands the limits by "scheduling" your property (more on that in a moment). Although you aren't technically required to keep an itemized list of UPP, keeping a home inventory checklist with your belongings and their estimated or approximate values listed is a still a good idea. Such a list can be invaluable if you suffer a total loss; the last thing you want to do after such a disaster is try and remember everything that was in your house. What are the coverage limits for unscheduled personal property? As mentioned above, coverage for UPP can be either actual cash value (ACV) or replacement cost (RCV), and doesn't necessarily have to match the coverage type you have for the dwelling. In other words, you can have RCV for your house but ACV for your belongings. It's worth noting that many insurance companies require a minimum percentage of coverage, such as 60% for RCV or 50% for ACV, but you are usually allowed to raise that limit based on your needs. In fact, many insurance carriers encourage policyholders to carry the full value of all the UPP they own to ensure they are fully covered. Often, personal items are overlooked if you make a list, or may be recently purchased and not included in the total value of coverage on the policy. Unless you are compulsive about updating your policy coverage values, these quoted percentages are likely to be too low in the event of a total loss. Of course, raising your unscheduled personal property coverage limit is likely to increase your premium by some amount. Scheduled vs unscheduled personal property

Depending on your carrier and coverage, there may be certain items that are not covered by UPP, or are specifically excluded. As mentioned, more expensive items, like jewelry, may be covered by UPP, but subject to a sublimit. In both cases, you may consider expanding your policy and scheduling your personal property with an optional "personal property floater endorsement" if one is available. Using jewelry as an example, let's look at how this might work and why you may need to schedule certain personal property on a floater endorsement. As you likely know, jewelry can cover a wide range of values; something like costume jewelry, or jewelry made from inexpensive metals, wouldn't cost as much to replace. In that instance, you likely wouldn't need to purchase a floater endorsement. However, if you have a family heirloom made with two ounces of 22-karat gold, that single item may exceed the jewelry sublimit of your UPP. In such a case, you would probably benefit from scheduling said heirloom on a personal property floater endorsement. Unlike UPP, when you purchase a floater endorsement to cover more expensive items, or items that don't fall under UPP, your carrier will ask you to fill out a special form. This is where you'll list specific items you want to have covered and how much you'll need in order to cover them. Of course, the insurer may require a third party appraisal of the property just to make sure the value and item description are accurate. Do you need to schedule your personal property? As we've discussed, determining whether or not you should schedule your personal property depends on a variety of individual factors. Not every insurance company has the exact same requirements as far as what property falls into the UPP category and what will need to be scheduled. If you're curious about coverage for certain more expensive items, you should first check the declarations page for your current homeowners, home, or property insurance policy. This should indicate your present coverage limits, and the policy language will identify any sublimits. Then, take a look at your personal belongings and create an estimate of what you believe they're worth. Apart from your more common household items, consider jewelry, furs, fine art, and any other personal property you feel might exceed your policy's sublimits. After going through this process, you can decide whether it's a good idea to reach out to your insurance agent to discuss the possibility of either raising your coverage limits or purchasing a scheduled personal property floater endorsement to expand your existing coverage.

0 Comments

Grand baby number 7 and Best of Parker County - Best Insurance Agency!

Thank you for voting us Best Insurance two years in a row! We are blessed! We truly appreciate our community, THANK YOU! THANK YOU! We look forward to serving you in 2023! Are your utility vehicles covered properly?

Theft of UTVs is a concern these days. Some policy’s have limits set for UTVs. Let’s chat! 817-220-7682 If you've been looking at life insurance policies, you've probably heard a number of different terms used at this point: whole life, universal life, permanent, level term, and so on. While these can all be great coverage options, the list isn't quite complete! Decreasing term life insurance is yet another type of policy available and while it shares many features with its counterparts, it is quite different. But what is decreasing term life insurance, exactly, and how does it work? Who is it right for and, perhaps more importantly, is it right for you? Let's find out!

What exactly is decreasing term life insurance? There are many different types of life insurance, so learning the particulars of each can be tricky. To get a better understanding of how a decreasing term policy works, let's take a look at some of the specifics and compare them to other life insurance products. How does a decreasing term policy work? As the name suggests, the death benefit of a decreasing term policy does just that: decreases. Like a level term policy, decreasing term policies often come with varying death benefit amounts and are available in various increments, such as 15, 20, 25, or 30 year plans. After selecting the policy particulars that are right for you, you would pay the premium, and over time, the death benefit of the policy reduces at a predetermined rate, usually each year. In the event that you (the policyholder) should pass during that time, the benefit is then paid to the beneficiary. So how is the rate determined? Unfortunately, there isn't a simple standard formula that can tell you exactly the amount the benefit decreases each year, or the rate at which it decreases. Like many things in the world of insurance, there are a variety of factors that are taken into consideration, such as the age of the applicant, their health, and the amount of life insurance coverage. However, the rate, as well as other policy specific information, should be made available to you after you request an initial quote from the insurance company. How is it different than other life insurance policies, like level term? In a previous blog, we discussed the differences between term and whole life insurance. Whole life policies are a type of permanent life insurance, which remain in effect as long as the policyholder pays the premiums. As mentioned, both level and decreasing term policies cover you for a specific period of time. Level and decreasing term policies also both have fixed premiums for the duration of their terms. However, the death benefit of a decreasing term goes down over time, whereas a level term policy stays the same over the life of the policy. You might ask yourself, "Why would anyone want a benefit that decreases?" That is a reasonable question, and we'll discuss why that might actually work towards your benefit in just a moment. Terminal or critical illness rider Some insurance carriers also offer something called a "critical or terminal illness rider" which can be added on to the decreasing term policy, and is usually added at no additional cost. Terminal illness riders give the policyholder the ability to access some portion of the death benefit while they are still alive in order to cover major medical costs or other related expenses. However, the benefit would only be paid out if the policyholder has been diagnosed with a terminal illness. A critical illness rider is similar, but may pay the amount in a single lump sum, whereas the terminal illness rider may be paid in installments, or as needed. In either case, the insurance company determines whether or not an illness or diagnoses is sufficient based on specifics outlined in the rider itself, and will likely vary between insurance providers. Finally, it is important to note that in some cases, a terminal or critical illness rider may only pay up to a certain percentage of the total death benefit. Why should someone consider buying a decreasing term policy? As we mentioned, the death benefit of a decreasing term policy goes down over time, but the premium stays the same. So why would you choose that over a level term policy? Let's take a look. Affordability Simply put, a decreasing term policy is often a more affordable option than a level term policy. Because the death benefit decreases over time, you're usually able to get a similar amount of coverage for a lower premium. For that reason, a decreasing term policy can be a way for an individual to get affordable coverage when the premiums of a similar level term policy may be cost-prohibitive. Furthermore, you may also be able to get a substantial amount of coverage without having to go through many of the same medical exams required by level term applications. Of course, this depends on the insurance carrier, and possibly your age, too. To cover debt and other financial obligations For many families, debt and other financial obligations typically decrease over time and thus, your need for a higher amount of coverage decreases, too. For example, if you are just starting a family, you probably have a fair number of financial obligations and loans. You have a mortgage, a car payment, and of course, the cost of raising a child. During that portion of your life, you certainly need a much larger amount of coverage. However, at some point, you'll pay off your car, make that last mortgage payment, and see your you child graduate from college and move off to build a life of their own. At that point, you likely don't need the same amount of coverage. While it certainly doesn't hurt to have the extra coverage provided by level term insurance, it may be the case that a new family can't afford the premiums, or otherwise need to find a more budget-friendly policy. In such a circumstance, a decreasing term might be a great option. Yet another use case can be found in the world of small businesses. When two or more people start a business together, they might find that a decreasing term policy is perfect for covering loans and other business expenses in the event that one of them should pass before they are paid off. How is a decreasing term policy different than credit or mortgage insurance? Some insurance carriers offer policies that are specifically designed to cover certain types of debt. For example, there are policies called "mortgage insurance" policies that specifically cover your mortgage in the event that you pass. Similarly, you can purchase insurance to cover other large amounts of debt, too. A decreasing term can be designed to match your mortgage, too, but one of the main differences between those policies has to do with who receives the benefit in the event of your passing (i.e. the beneficiary). In the case of mortgage insurance, the death benefit will more than likely go to the mortgage lending company or the bank rather than a spouse or loved one. While the death benefit from a decreasing term might go to the bank anyway, it's hard to know exactly what your family may need in the event of something so unexpected and there a number of reasons you may want the payment to go to them rather than the bank. Maybe you are further along in your mortgage payments than you thought you might be, or perhaps your family needs the benefit for some unforeseen expense. In any case, a decreasing term policy would allow you to name a spouse or loved one as the beneficiary, which means they can decide how to allocate the funds. Proud to be your local Germania Agent for over 25 years!

Organized in 1896 in Perry, Texas, Germania was initially formed to provide protection for rural farm property in small communities against losses due to storms, fire, and lightning. Germania moved its headquarters to Brenham in 1898 and has since expanded into multiple companies to provide a variety of coverages and services to policyholders across the state.

|

| | Check us out on Facebook to learn more! |

Are firearms covered under homeowners insurance?

No matter how carefully you clean and maintain your firearm, unexpected things can happen. Even if you store them in a fire-resistant safe, there is no guarantee that they won't be severely damaged in the event of a disaster.

For this reason, many people choose to purchase insurance for their firearms. There are a number of companies and organizations that provide specialty firearm insurance. However, before you purchase a separate policy, make sure to check with your homeowners or home insurance company and ask if they provide coverage for firearms.

Most home insurance policies have a section called "unscheduled personal property" which provides some amount of coverage for personal belongings that aren't otherwise listed. This might include items such as computer equipment, but can often cover firearms as well.

That having been said, keep in mind that insurance companies often have coverage limits for firearms, not just in terms of a dollar amount, but the specific quantity of firearms. In other words, they may place a limit on the number of guns the policy will replace in the event that they are destroyed in a covered disaster. As always, policy specifics vary from provider to provider, so be sure to ask yours about firearm coverage limits.

For this reason, many people choose to purchase insurance for their firearms. There are a number of companies and organizations that provide specialty firearm insurance. However, before you purchase a separate policy, make sure to check with your homeowners or home insurance company and ask if they provide coverage for firearms.

Most home insurance policies have a section called "unscheduled personal property" which provides some amount of coverage for personal belongings that aren't otherwise listed. This might include items such as computer equipment, but can often cover firearms as well.

That having been said, keep in mind that insurance companies often have coverage limits for firearms, not just in terms of a dollar amount, but the specific quantity of firearms. In other words, they may place a limit on the number of guns the policy will replace in the event that they are destroyed in a covered disaster. As always, policy specifics vary from provider to provider, so be sure to ask yours about firearm coverage limits.

| For many Texans, firearms are an important part of life. That's why Germania doesn't put limits on the number of firearms our home insurance covers. |

When your property is damaged or destroyed, you know that your insurance provider will write a check to help cover the loss. But do you know exactly how the value of that check is determined? Will your insurance provider pay the actual cash value or the replacement cost of the damaged property? What is the difference between the two, anyway? Understanding these concepts is essential to understanding your insurance policy, so today, we're taking a closer look at actual cash value vs. replacement cost - read on!

Is actual cash value the same as replacement cost? What's the difference?

When you think of the monetary value of a particular piece of property, how do you arrive at a number? Do you think back to the sticker price you paid at the store? If it's a relatively recent purchase, that may be fairly accurate, but what if you've owned the property for a few years? Do you factor in wear, tear, and depreciation?

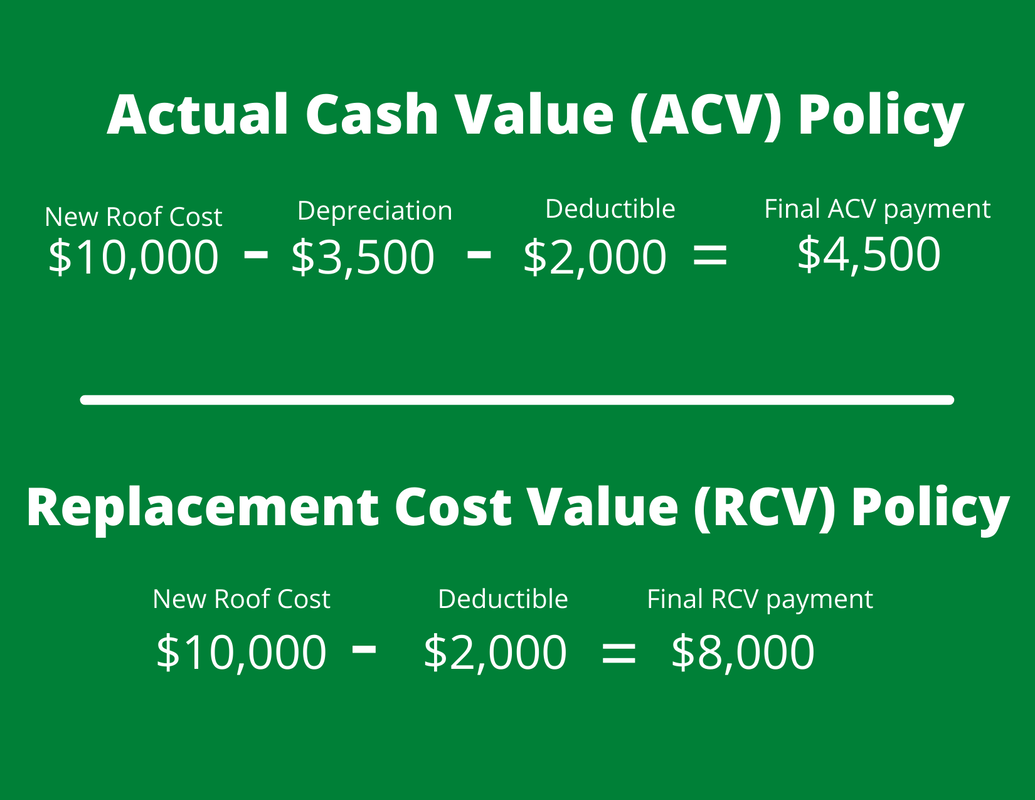

These are all important things to consider, especially when it comes to replacing a piece of property damaged by a covered loss. That's why insurance companies generally divide the value of a reimbursement into two categories: actual cash value (ACV) or replacement cost (RCV). They may sound relatively similar, but they actually can function quite differently.

Actual cash value coverage

To begin, let's take a look at a plausible example. Let's say that you recently purchased a brand new TV for $4,000, and unfortunately, it was destroyed in a fire. If the personal property portion of your home insurance uses ACV, the payment will likely be less than the initial $4,000 you paid at the store.

This is because ACV takes the initial cost of the item and deducts depreciation from it. So, how does a claims adjuster determine depreciation? In many cases, they don't (or can't) inspect the piece of property in question directly. Instead, the value is based on the "life span" of the item. If your TV had a life span of 10 years, then it would have $400 per year deducted from the ACV for every year that you owned it. In this case, if you had this TV for three years before the fire, it would have depreciated by $1200, and the ACV payment from your insurance company would be $2800 (minus your deductible, of course).

This is just an example, and the method by which a carrier determines an item's value and life span will vary from company to company. Regardless of the particular method used, the life span value is meant to account for the normal wear and tear property undergoes, as well as the normal decrease in value that most items experience over time. For example, a TV isn't likely to increase in value, or even maintain its value over the years. Even if it's in great condition, the older it becomes, the more its value has depreciated.

Replacement cost coverage

Replacement cost coverage is a little more straightforward. This refers to a payment which equals the initial cost, or the cost you would have to pay to replace the property today, without factoring in depreciation.

Let's look at the example of our unfortunate TV that was lost in a fire. If your insurance policy coverage is RCV, it would pay to replace your property at full cost (again, minus your deductible). In other words, it would allow you to buy a new TV, or one that was similar in kind and quality to the one you lost in the fire. Of course, this payment won't exceed the personal property coverage limits outlined in your policy. That's why it's important to make sure that your coverage limits are equal to the value of the property you're insuring.

Whether your coverage is ACV or RCV, if you have high-end electronics, expensive art, or other rare and expensive valuables, you may need to consider an additional endorsement to your existing policy. Depending on your coverage limits, the personal property portion of your homeowners insurance policy may not be enough to cover RCV reimbursement for such items.

How do I know whether my insurance policy uses actual cash value or replacement cost reimbursement?

If you already have an insurance policy, such as a home or property policy, then you'll want to review your declarations page. This document simply outlines the specifics of your policy. In addition to stating whether your coverage is ACV or RCV, it should show other helpful information, such as your premium, your coverage limits, and any deductibles you may have. If you need another copy of your declarations page, your insurance provider or agent should be able to help you get a hold of one.

How does actual cash value and replacement cost coverage work with different insurance policies?

Homeowners insurance. Coverage is normally split between personal property coverage and dwelling coverage. Most homeowners insurance offers replacement cost coverage for the dwelling (your actual home), and possibly other structures, such as a storage shed or detached garage.

On the other hand, the personal property portion of your coverage will more than likely be actual cash value. However, many insurance carriers will allow you to upgrade your personal property coverage from ACV to RCV if you are willing to pay a higher premium.

It is important to keep in mind that the type of coverage offered will likely depend on the age and condition of your home. This is especially true for your home's roof - while your dwelling may be covered at RCV, if your roof is old or worn, it may only be covered at ACV.

Renters insurance. As you may know, renters insurance is designed to cover your personal belongings inside a home that you rent rather than covering the dwelling itself. Like homeowners insurance, the type of coverage your renters insurance offers will depend on your carrier and the specifics of your policy. While renters insurance coverage is often ACV, it is certainly possible that your provider offers an upgrade to RCV. Fortunately, renters insurance is often affordable, and policyholders can typically get RCV while maintaining a relatively low premium.

Auto insurance. Cars are notoriously bad at maintaining their value, and it is often said that they begin depreciating the moment you drive them out of the dealership. For this reason, auto insurance coverage is normally actual cash value and many insurers do not offer replacement cost coverage. Those that do will often do so through an endorsement, although they will usually have fairly strict requirements in terms of the vehicle's age and mileage.

Which is better: actual cash value or replacement cost?

Generally, receiving the replacement cost as reimbursement is more helpful for policyholders than actual cash value coverage following a disaster or incident of theft. If you're concerned that your property won't be adequately covered with ACV, then RCV could be just the thing you need. However, selecting this option for your policy will come at a greater premium, sometimes substantially so. Furthermore, your carrier may have strict guidelines or restrictions regarding what property they will cover at replacement cost, and what condition it must be in before they will do so.

For these reasons, it is difficult to say that one option is better than the other in the long run as it will depend on your specific insurance needs - you may find that changing your policy to RCV isn't worth the increased premium. If, for example, you live in an area that has a very low risk of disasters or theft, or if you simply don't have a lot of property to cover, you might be satisfied with the coverage that ACV provides. While RCV is recommended for certain property (like your home), you may find that other less valuable items simply don't justify the increased premium.

Let's look at the example of our unfortunate TV that was lost in a fire. If your insurance policy coverage is RCV, it would pay to replace your property at full cost (again, minus your deductible). In other words, it would allow you to buy a new TV, or one that was similar in kind and quality to the one you lost in the fire. Of course, this payment won't exceed the personal property coverage limits outlined in your policy. That's why it's important to make sure that your coverage limits are equal to the value of the property you're insuring.

Whether your coverage is ACV or RCV, if you have high-end electronics, expensive art, or other rare and expensive valuables, you may need to consider an additional endorsement to your existing policy. Depending on your coverage limits, the personal property portion of your homeowners insurance policy may not be enough to cover RCV reimbursement for such items.

How do I know whether my insurance policy uses actual cash value or replacement cost reimbursement?

If you already have an insurance policy, such as a home or property policy, then you'll want to review your declarations page. This document simply outlines the specifics of your policy. In addition to stating whether your coverage is ACV or RCV, it should show other helpful information, such as your premium, your coverage limits, and any deductibles you may have. If you need another copy of your declarations page, your insurance provider or agent should be able to help you get a hold of one.

How does actual cash value and replacement cost coverage work with different insurance policies?

Homeowners insurance. Coverage is normally split between personal property coverage and dwelling coverage. Most homeowners insurance offers replacement cost coverage for the dwelling (your actual home), and possibly other structures, such as a storage shed or detached garage.

On the other hand, the personal property portion of your coverage will more than likely be actual cash value. However, many insurance carriers will allow you to upgrade your personal property coverage from ACV to RCV if you are willing to pay a higher premium.

It is important to keep in mind that the type of coverage offered will likely depend on the age and condition of your home. This is especially true for your home's roof - while your dwelling may be covered at RCV, if your roof is old or worn, it may only be covered at ACV.

Renters insurance. As you may know, renters insurance is designed to cover your personal belongings inside a home that you rent rather than covering the dwelling itself. Like homeowners insurance, the type of coverage your renters insurance offers will depend on your carrier and the specifics of your policy. While renters insurance coverage is often ACV, it is certainly possible that your provider offers an upgrade to RCV. Fortunately, renters insurance is often affordable, and policyholders can typically get RCV while maintaining a relatively low premium.

Auto insurance. Cars are notoriously bad at maintaining their value, and it is often said that they begin depreciating the moment you drive them out of the dealership. For this reason, auto insurance coverage is normally actual cash value and many insurers do not offer replacement cost coverage. Those that do will often do so through an endorsement, although they will usually have fairly strict requirements in terms of the vehicle's age and mileage.

Which is better: actual cash value or replacement cost?

Generally, receiving the replacement cost as reimbursement is more helpful for policyholders than actual cash value coverage following a disaster or incident of theft. If you're concerned that your property won't be adequately covered with ACV, then RCV could be just the thing you need. However, selecting this option for your policy will come at a greater premium, sometimes substantially so. Furthermore, your carrier may have strict guidelines or restrictions regarding what property they will cover at replacement cost, and what condition it must be in before they will do so.

For these reasons, it is difficult to say that one option is better than the other in the long run as it will depend on your specific insurance needs - you may find that changing your policy to RCV isn't worth the increased premium. If, for example, you live in an area that has a very low risk of disasters or theft, or if you simply don't have a lot of property to cover, you might be satisfied with the coverage that ACV provides. While RCV is recommended for certain property (like your home), you may find that other less valuable items simply don't justify the increased premium.

If you're shopping for insurance and trying to decide whether or not you should go with actual cash value or replacement cost coverage, you should always speak with your insurance provider or insurance agent for further guidance. However, at the end of the day, only you can decide what type of coverage is best for you!

If you're shopping for insurance and trying to decide whether or not you should go with actual cash value or replacement cost coverage, you should always speak with your insurance provider or insurance agent for further guidance. However, at the end of the day, only you can decide what type of coverage is best for you!

Contact Us

(817) 220-7682

905 E Hwy 199

Springtown, TX 76082

Click Here to Email Us

Archives

January 2023

December 2022

February 2022

January 2022

July 2021

June 2021

February 2021

January 2021

September 2020

July 2020

August 2019

October 2017

RSS Feed

RSS Feed